IRS rules allow you to exclude up to $250,000 ($500,000 if married) of gain from the sale of your main home, if you owned and occupied the home for at least two of the last five years. In most cases, you do not need to report the sale of your home if your gain is less than $250,000 (or $500,000 if married) and you owned and occupied your home for at least two of the last five years.

If you did not own and occupy your home for two of the past five years, then you must report the sale of your home on your tax return.

Also, you may need to report the sale of your home if any of the following is true:

- You claimed the First-Time Homebuyer Credit.

- You used your home for business or rental purposes.

- You received IRS Form 1099S.

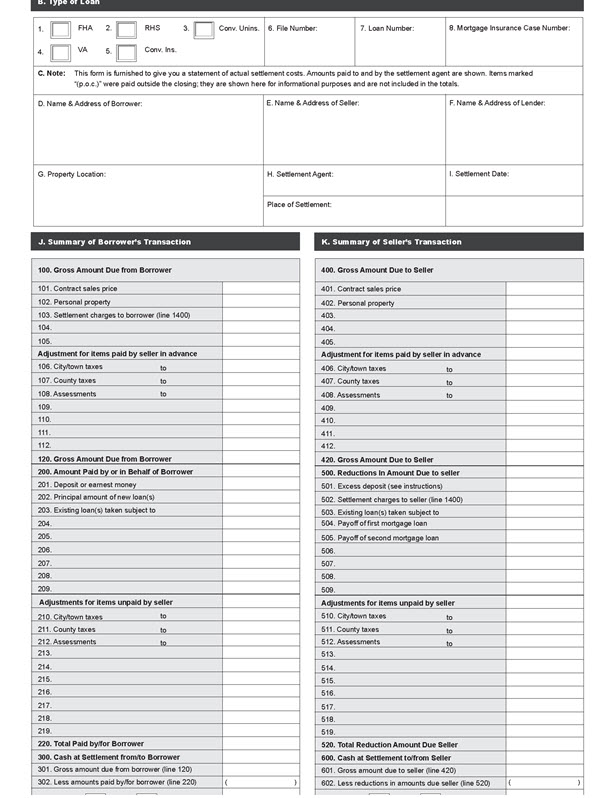

Settlement (HUD) Statement

Closing papers show important information relating to the sale of your home. If you purchased or sold your home during the year, please bring copies  of Good Faith Estimates from:

of Good Faith Estimates from:

- The purchase of your home

- The sale of your home, and

- From all refinances you made on the home during the time you owned it.

Adobe Acrobat Reader is required to view this file

Download Free Adobe Reader