Not sure what tax documents you should bring? Here are some illustrations of what various documents look like and if you should expect to receive them.

Should I have this document? |

What the Document Looks Like |

|---|---|

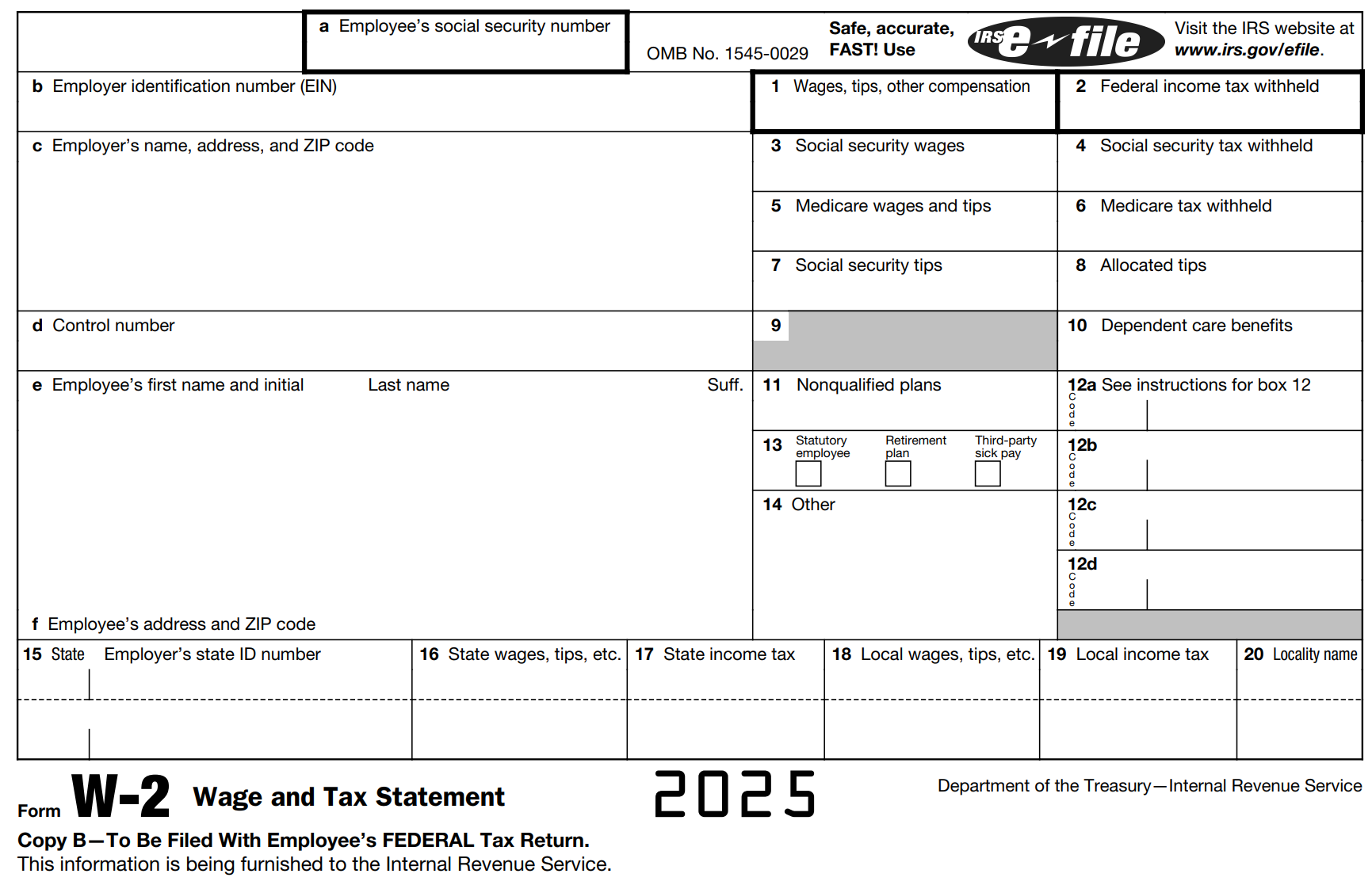

Form W-2You will receive this form if you worked for wages during the year.

|

|

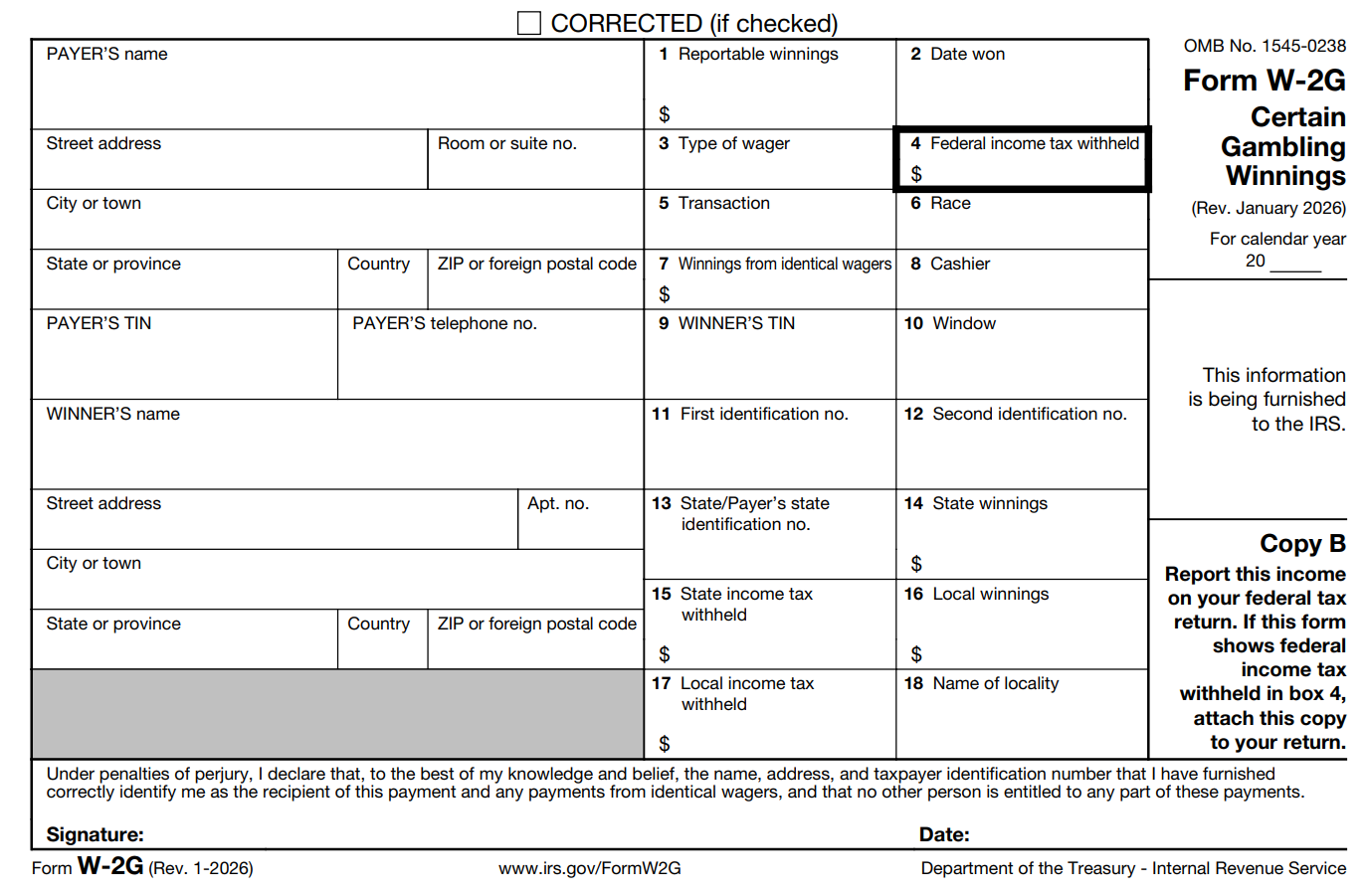

W-2GYou will receive this document to report gambling wins you received. |

|

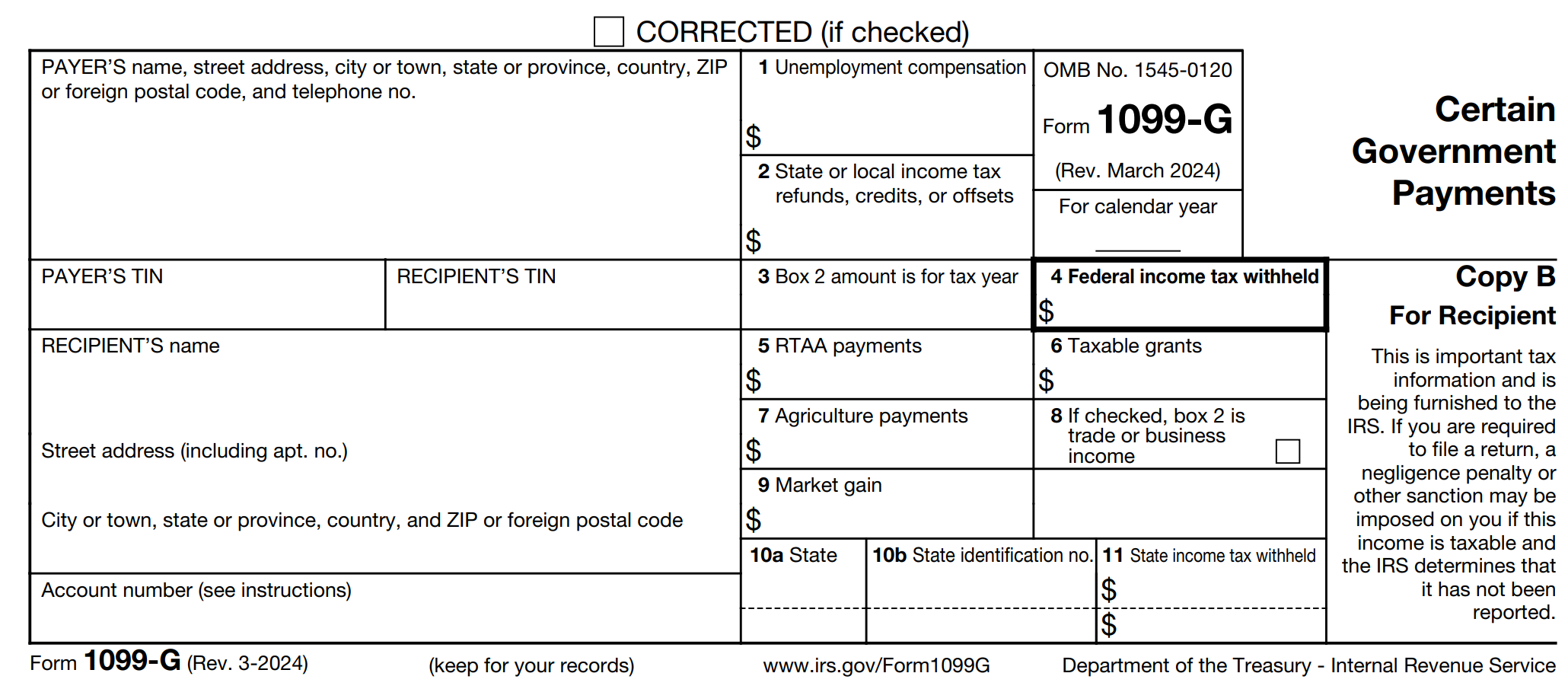

Form 1099-GYou will receive this form from your state if you received a state refund for a tax year where you itemized deductions, or If you received unemployment compensation. |

|

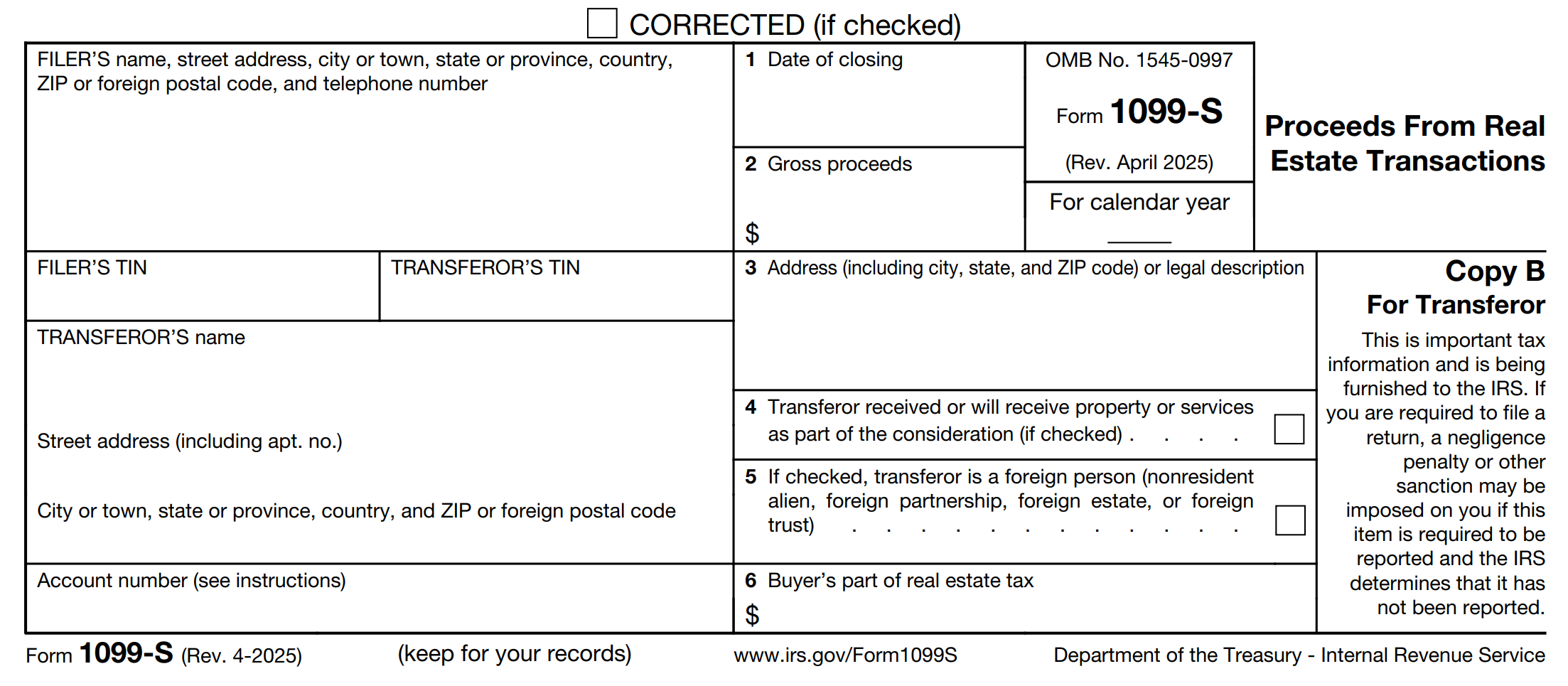

1099-SYou will receive this form if you sold your home or other real estate. |

|

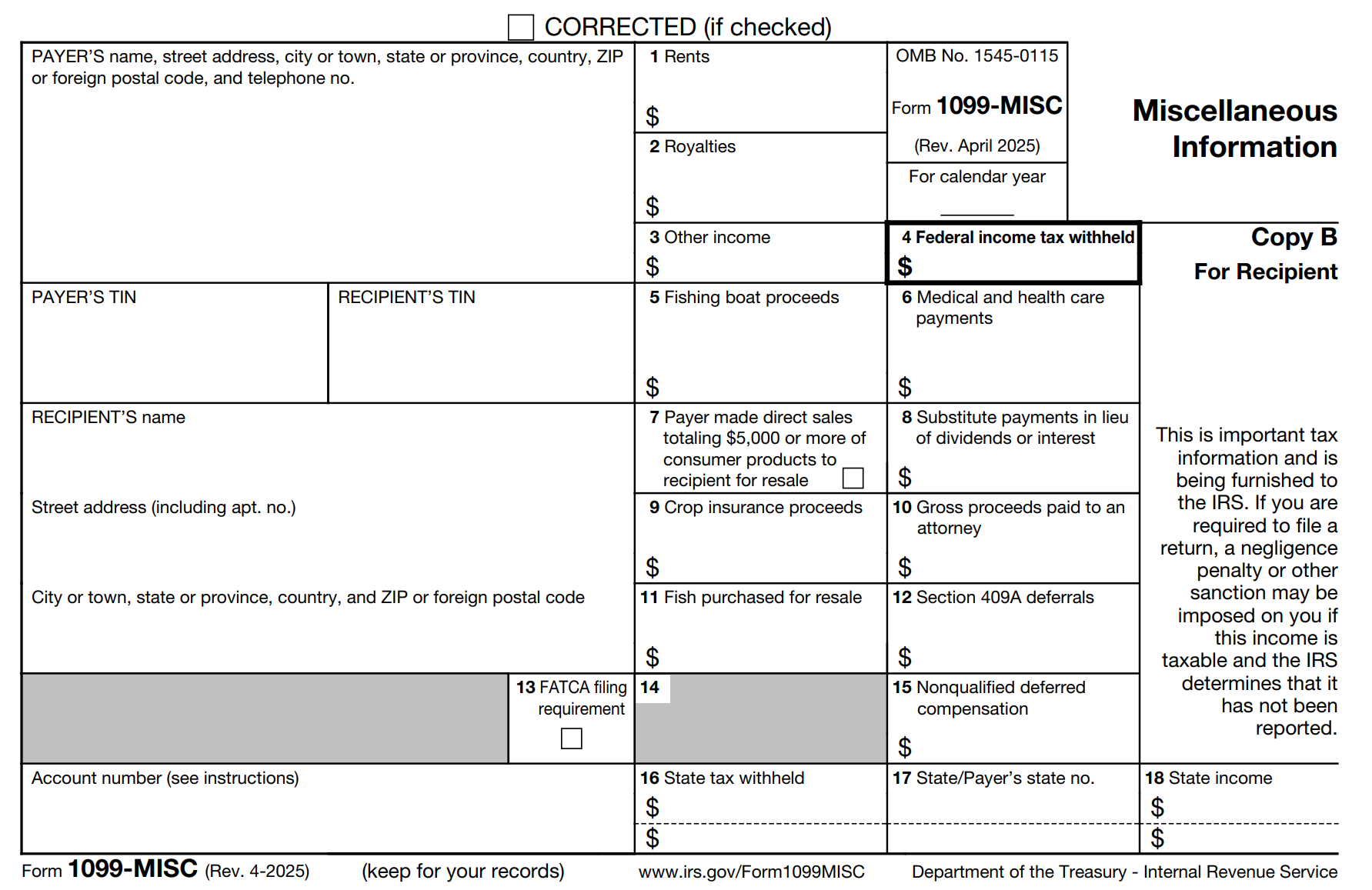

1099-MISCThis document is issued if you were paid one of several different types of income. The most common income reported is Box 7 Nonemployee Compensation. |

|

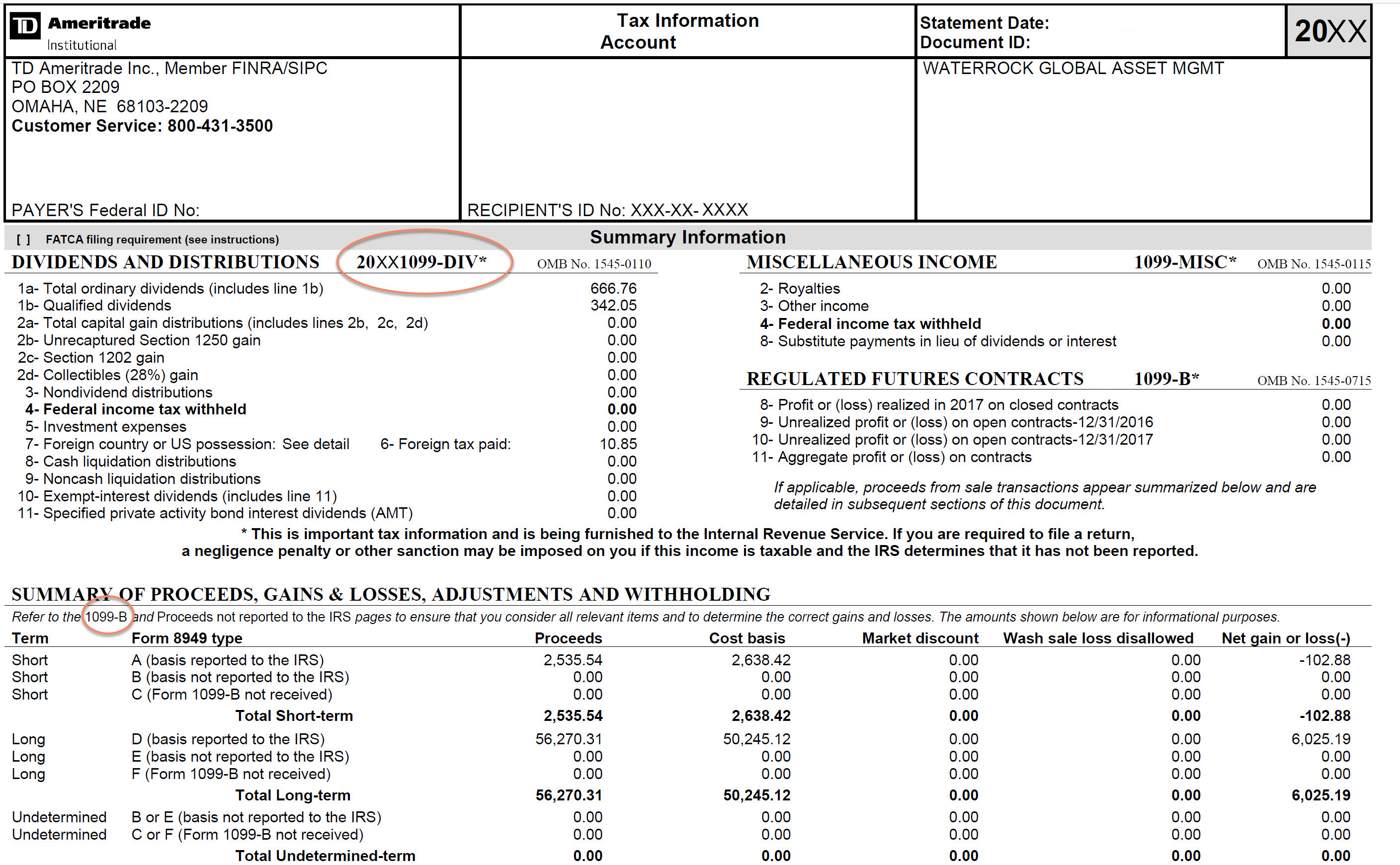

1099-BMost companies issue a substitute 1099-B document that may look like this one. Look for "1099" or "Substitute 1099-B" imprinted on the document. 1099-DIV1099-DIV documents may be stand-alone forms or they may be combined with Forms 1099B or 1099-INT as you see in this illustration |

|

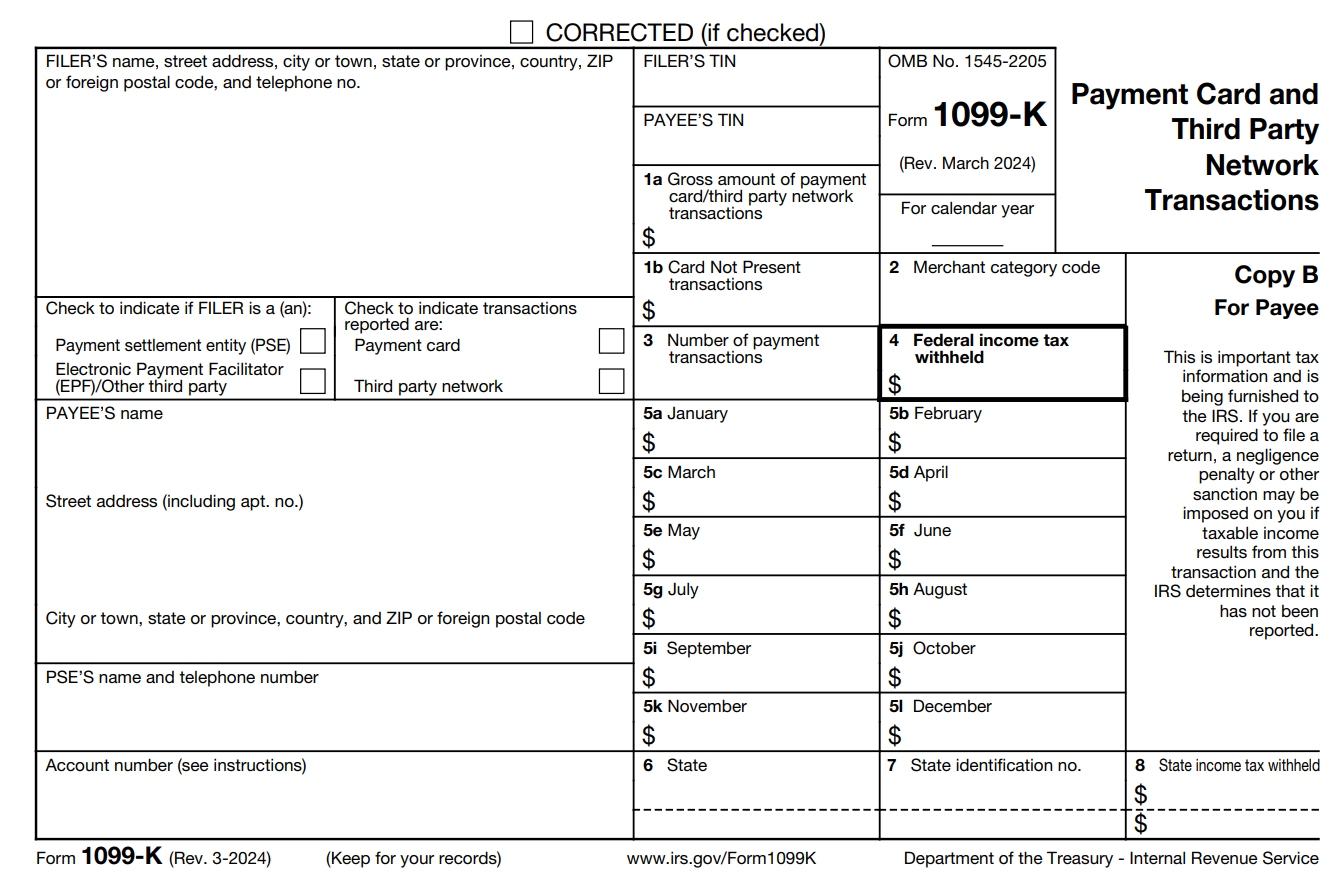

1099-KYou will receive this form if: Your business accepts credit card payments, or You traded Bitcoin or other cryptocurrencies, or You sold products through PayPal or other 3rd party network providers.

|

|

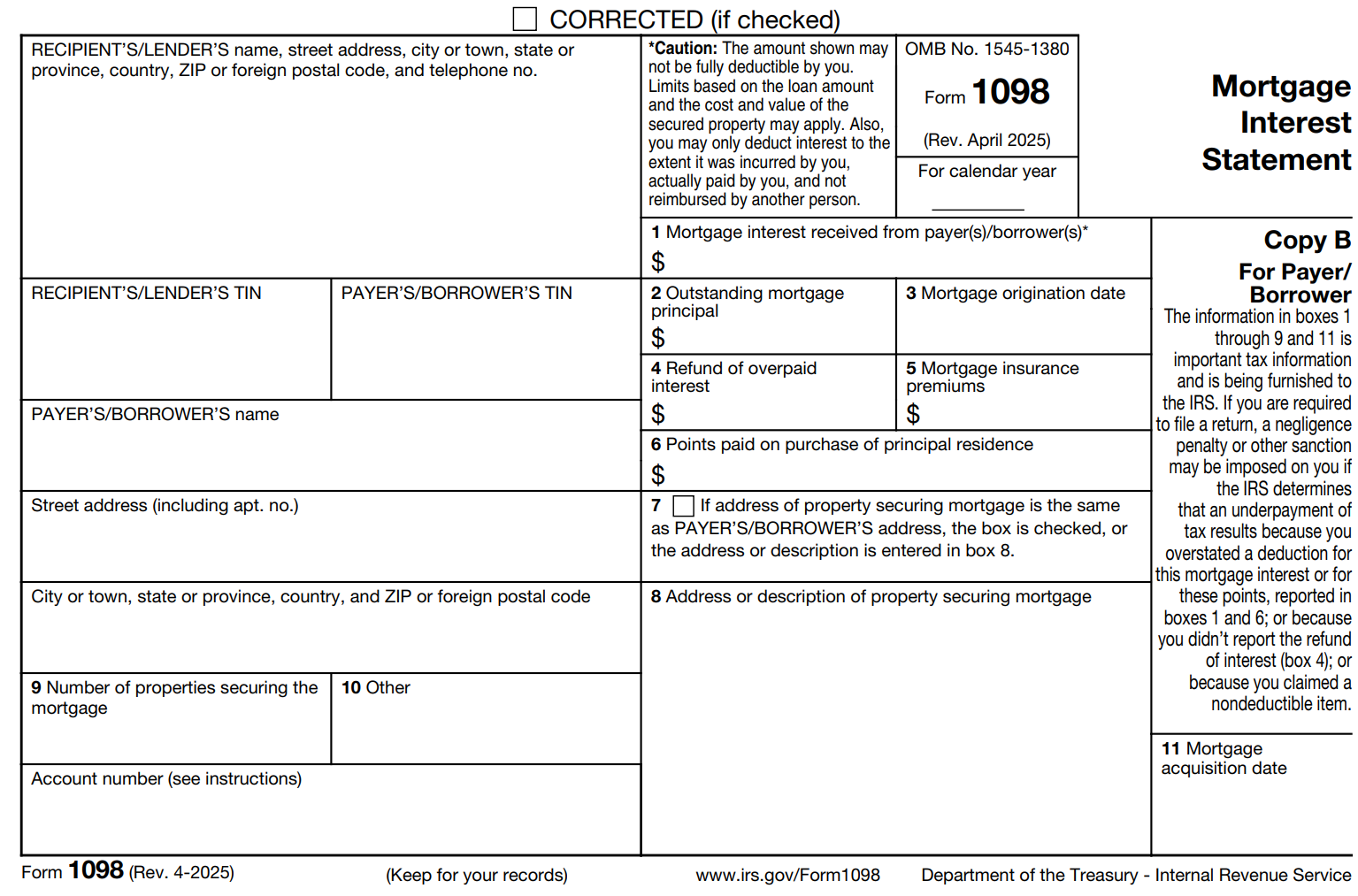

1098Bring this document to show how much mortgage interest you paid for the year. If you have more than one mortgage, then bring a separete 1098 for each mortgage you have. |

|

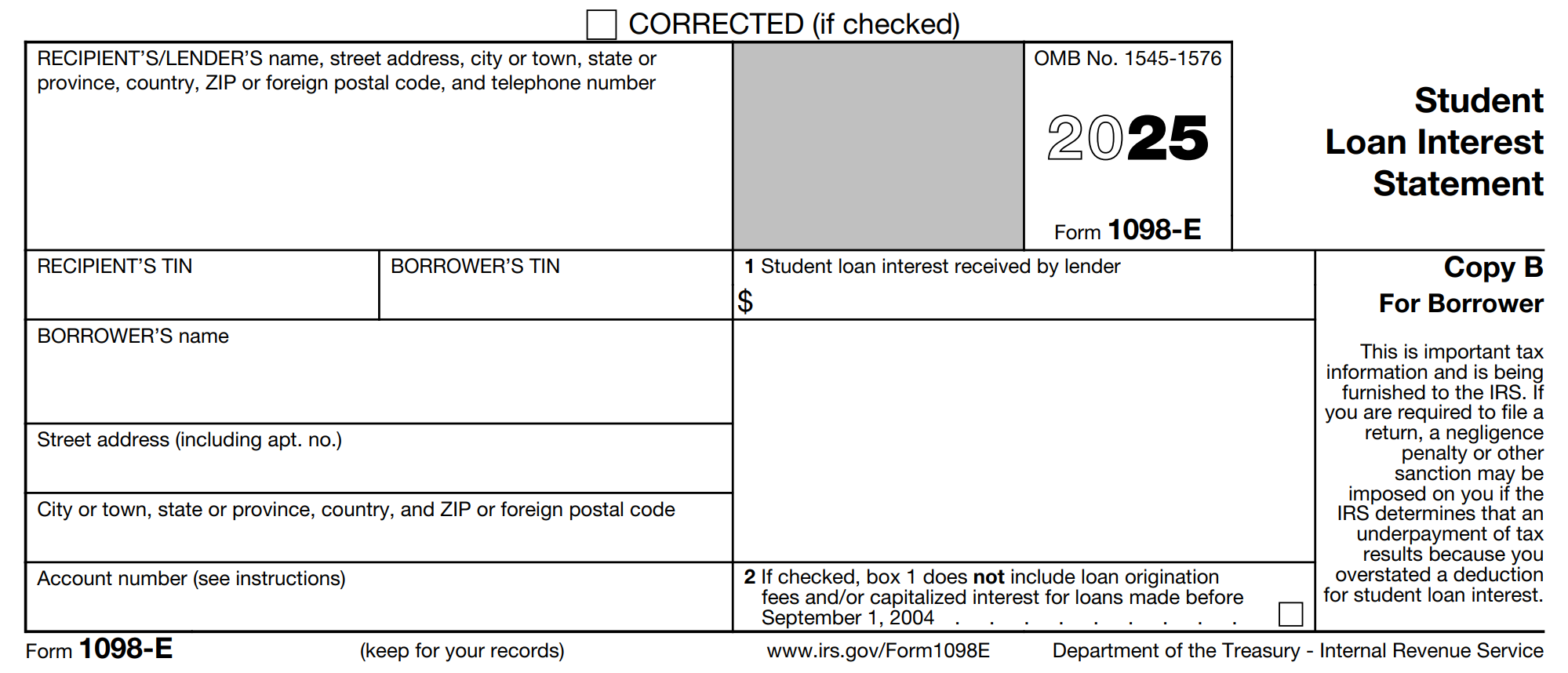

1098-EBring this document to show how much student loan interest you paid for the year. |

|

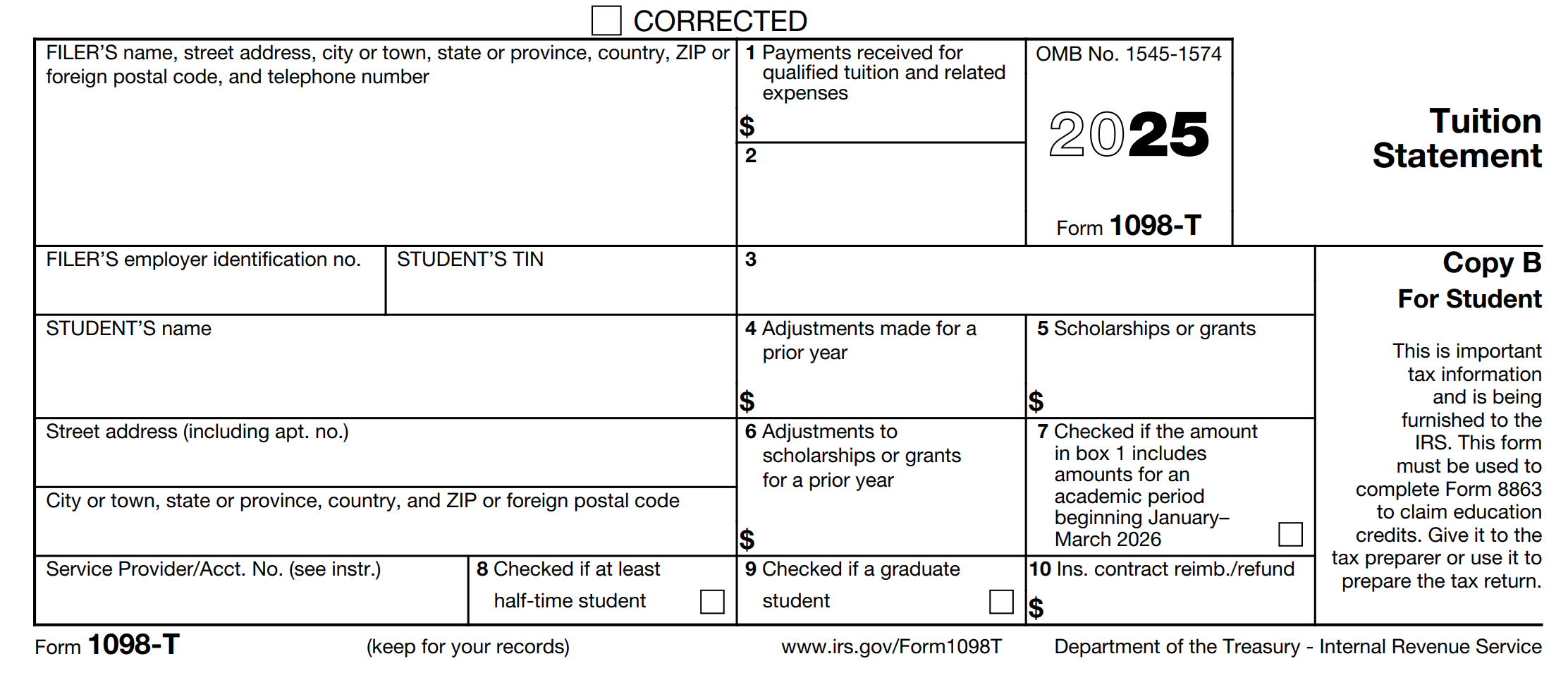

1098-TBring this document even if it was issued to your child and you did not pay any tuition. |

|

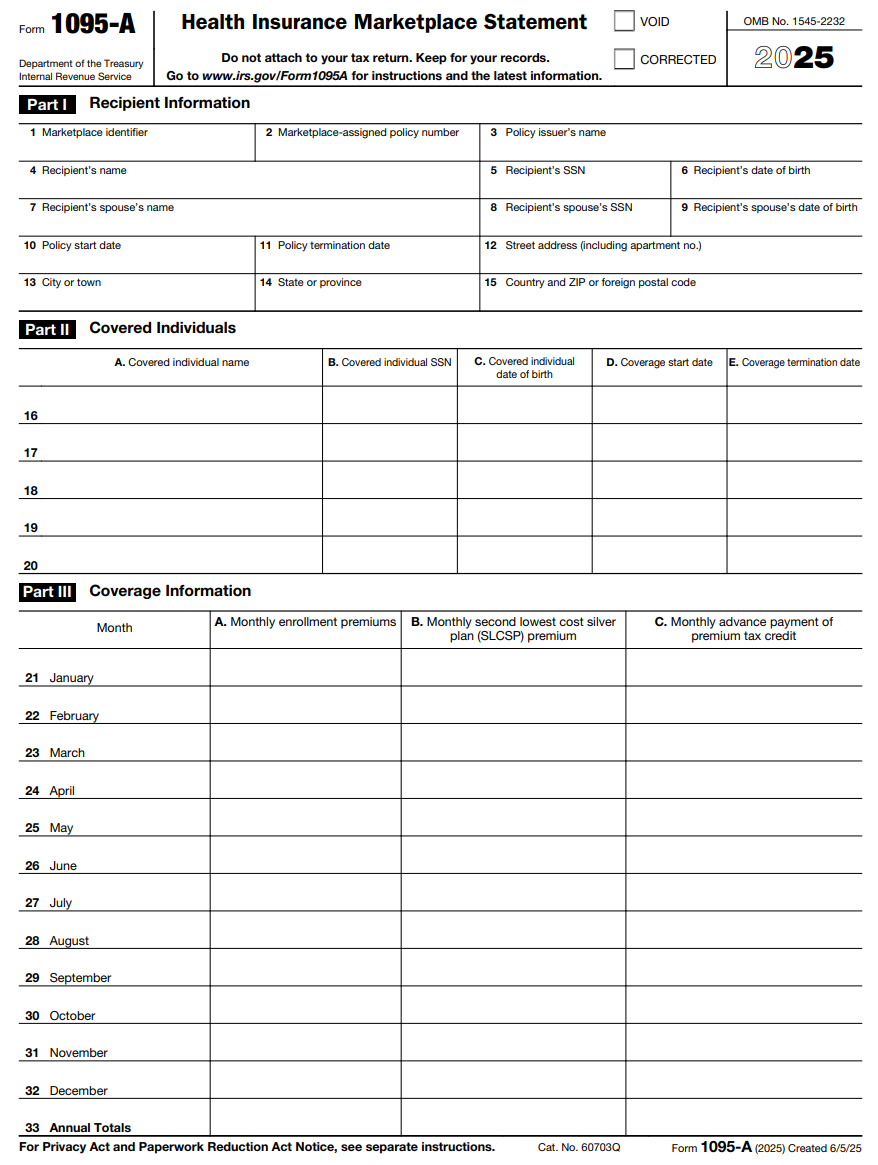

Form 1095-AIf you purchased health insurance form the health insurance marketplace, you will need to bring this form. If you didn't receive it, log into healthcare.gov or your state's health insurance exchange and download it from there. |

|

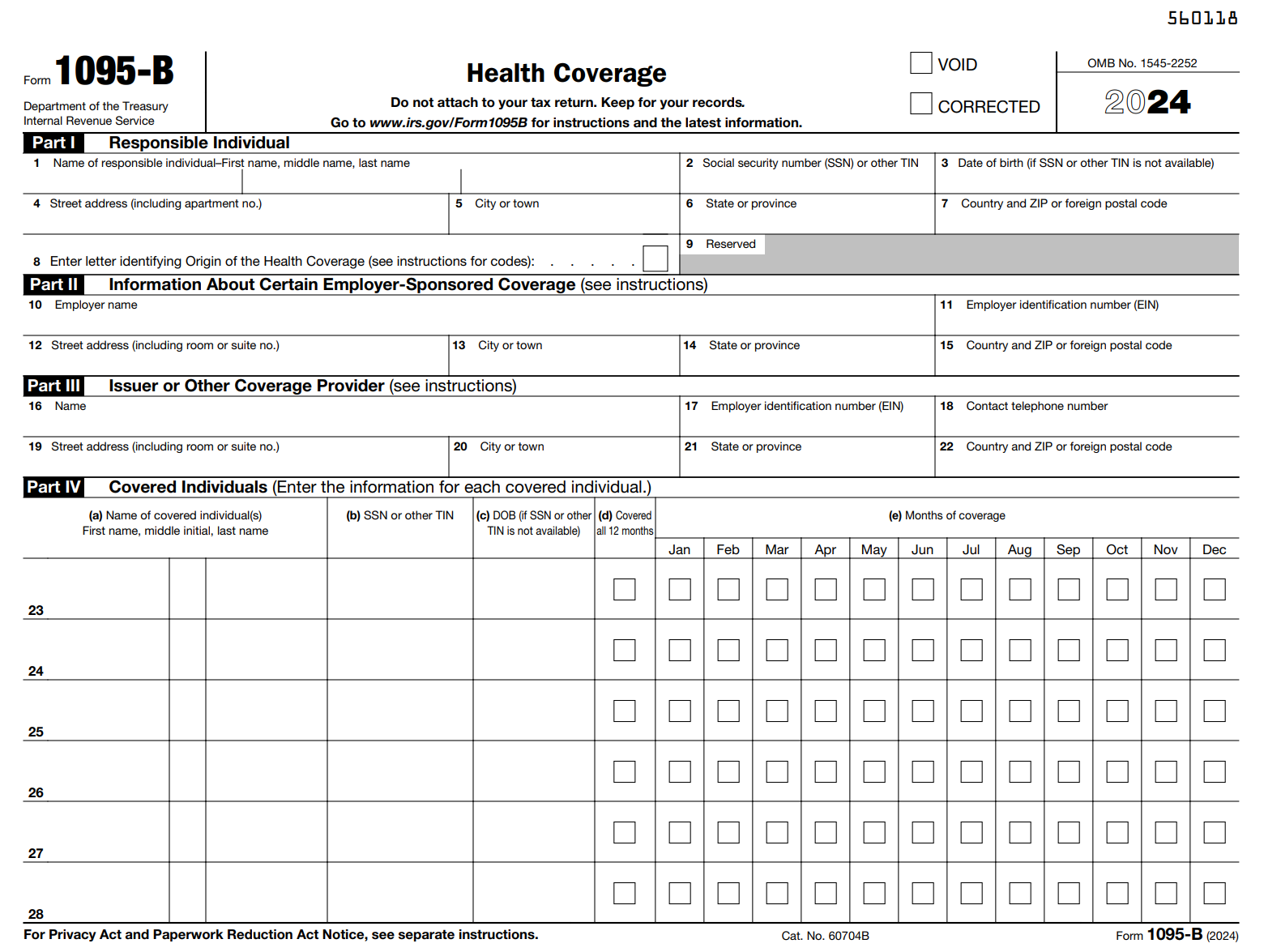

Form 1095-BIf you received health insurance coverage from your employer, or you purchased your insurance directly from an insurance company, you should receive this form. |

|

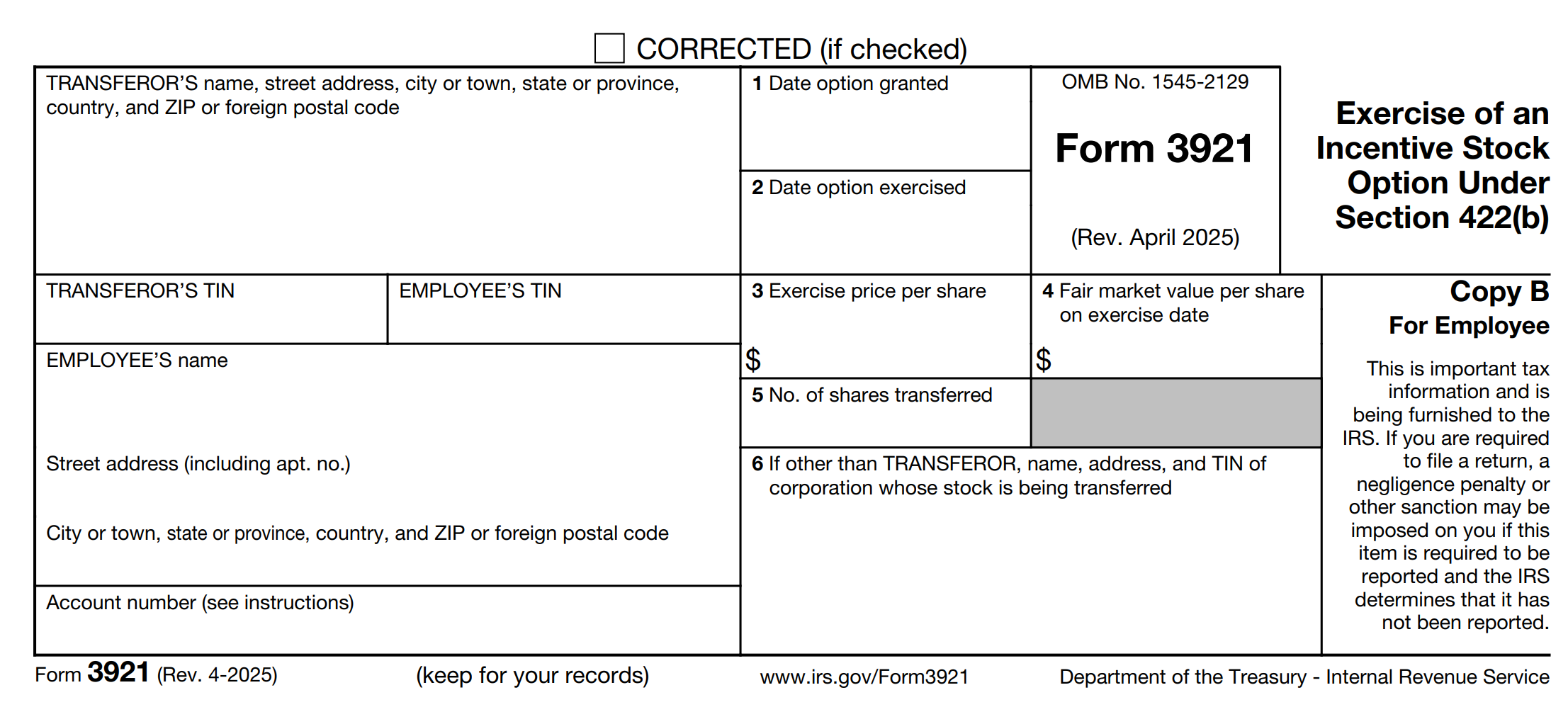

Form 3921You receive this form in the year you purchase qualified incentive stock options. |

|

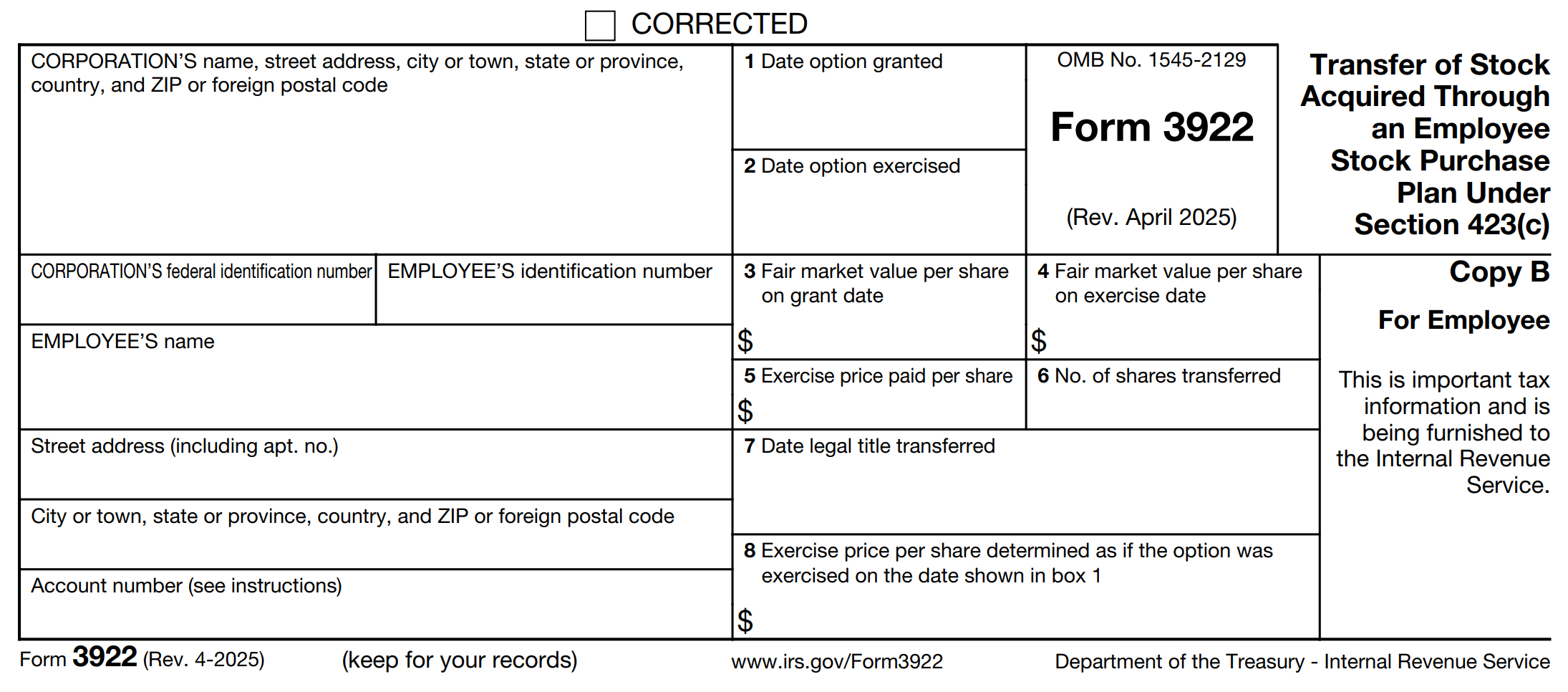

Form 3922You receive this form in the year you purchase stock under an (ESPP) Employee Stock Purchase Plan. Note: Form 3922 is issued in the year you purchase the stock. Save this form for use in the year you sell the stock. |

|